Guide to Simple Moving Average

Moving Average is probably one of the simplest and most popular indicators in technical analysis (including the Forex market).

Moving average refers to the class of indicators following the trend, it helps to determine the beginning of a new trend and its completion, its force angle (speed) can be determined from its angle of inclination, it is also used as a basis (or smoothing factor) in a large number of other technical indicators . Sometimes the moving average is called the trend line.

Simple Moving Average Formula

Where Pi – Prices in the market (Prices are usually taken Close, but sometimes they use Open, High, Low, Median Price, Typical Price).

N – the main parameter – the length of the smoothing or the period of the moving average (the number of prices included in the calculation of the sliding one). Sometimes this parameter is called the moving average order.

Example of a scooping average :

A moving average with a parameter of 5.

Description of Simple Moving Average

A simple moving average is the usual arithmetic mean of the prices for a certain period. The moving average is a measure of the equilibrium price (the equilibrium of supply and demand in the market) for a certain period, the shorter the moving average, the less the equilibrium is taken over a shorter period. Averaging prices, it always follows a certain lag behind the main market trend, filtering small fluctuations. The smaller the parameter of the moving average (say that the moving average is shorter), the faster it determines the new trend, but simultaneously makes more false fluctuations, and vice versa, the larger the parameter (say the long moving average), the slower a new trend is determined, but fewer false fluctuations occur.

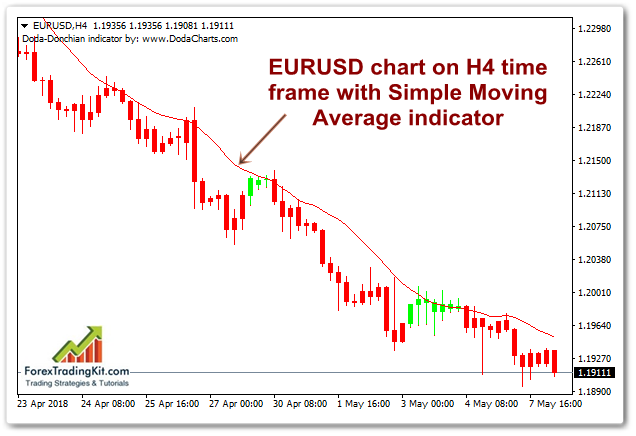

Usage of Simple Moving Average

The use of moving averages is quite simple. Moving averages do not predict changes in the trend but only signal about the trend that has already appeared. Since moving averages are trend following indicators, they are better used in trend periods, and when the trend is not present on the market, they become absolutely inefficient. Therefore, before using these indicators, it is necessary to conduct a separate analysis of the properties of the trend of a particular currency pair. In the simplest form, we know several ways to use the moving average.

There are 7 basic methods of moving average :

- Determination of the trade side using the moving average. If it is directed upwards, then you make only purchases, if down – then only sales. In this case, the entry and exit points from the market are determined on the basis of other methods of moving averages (including on the basis of a faster moving one).

- Turning the moving average from the bottom up with a positive slope of the price chart itself is seen as a buy signal, moving the moving average from top to bottom with a negative slope of the price chart itself is considered a sell signal.

- The moving average method, based on the intersection of the price of its sliding downward (with a negative slope of both) is considered a sell signal, the intersection of its moving average price from the bottom up (with a positive slope of both) is considered a buy signal.

- The intersection of the long moving average with a short bottom-up is considered as a signal to buy and vice versa.

- Moving averages with round periods (50, 100, 200) are sometimes considered as sliding levels of support and resistance.

- Proceeding from the fact that the sliding is directed upward, and which down determine what is the upward trend and what is the descending (short, medium, long-term).

- The moments of the greatest discrepancy between the two averages with different parameters are understood as a signal to a possible trend change.

Disadvantages of the moving average method

- When using the moving average method for trend trading, the delay at the entrance and exit from the trend is usually very significant, so in most cases, the majority of the trend movement is lost.

- In the outset (trading range) and especially in the lateral trend in the form of a saw, gives a lot of false signals and leads to losses. In this case, a trader trading on the basis of a simple sliding cannot skip these signals, since each of them is a potential signal of entering the trend.

- When you enter the price calculation, which differs from the level of prices in the market, the moving average varies greatly. When this price leaves the sliding calculation, a strong change occurs again. This effect A. Elder called “bad dog barks twice.”

- One of the most serious shortcomings of the moving average method is that it gives the same weight to both newer prices and to older prices, although it would be more logical to assume that new prices are more important because they reflect a market situation closer to the current moment.

Note 1: In the market in a state of a trend, it is better to use a shorter sliding one, in the market in the outset it is better to use a longer sliding one, as giving less false signals.

Note 2: there are a lot of more effective modern variations: exponential moving average, weighted moving average, there are also a number of adaptive moving averages AMA, KAMA, Jurik MA, etc.

Risk warning: we do not recommend using any indicators on real accounts without first testing their work on a demo account or testing as a trading strategy. Anyone, even the best indicator, applied incorrectly, gives a lot of false signals and as a consequence can bring significant losses in the process of trading.