Japanese Candlestick Complex Patterns

This article explains all Japanese Candlestick Complex Patterns. There are about 22 Japanese Candlestick Complex Patterns, formed by the combination of 2 or more candles on the technical chart.

Japanese Candlestick Complex Patterns

| S.No. | Candle Pattern Image | Candle Pattern Name | Candle Pattern Description |

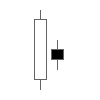

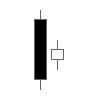

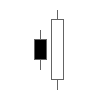

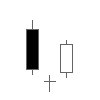

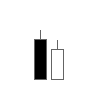

| 1. |  | Bearish Harami | Bearish Harami Consists of an unusually large white body followed by a small black body (contained within large white body). It is considered as a bearish pattern when preceded by an uptrend. |

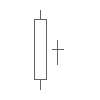

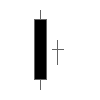

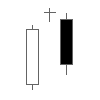

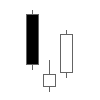

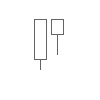

| 2. |  | Bearish Harami Cross | Bearish Harami Cross A large white body followed by a Doji. Considered as a reversal signal when it appears at the top. |

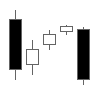

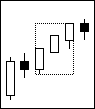

| 3. |  | Bearish 3-Method Formation | Bearish 3-Method Formation A long black body followed by three small bodies (normally white) and a long black body. The three white bodies are contained within the range of first black body. This is considered as a bearish continuation pattern. Bearish 3-Method Formation A long black body followed by three small bodies (normally white) and a long black body. The three white bodies are contained within the range of first black body. This is considered as a bearish continuation pattern. |

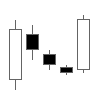

| 4. |  | Bullish 3-Method Formation | Bullish 3-Method Formation Consists of a long white body followed by three small bodies (normally black) and a long white body. The three black bodies are contained within the range of first white body. This is considered as a bullish continuation pattern. |

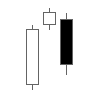

| 5. |  | Bullish Harami | Bullish Harami Consists of an unusually large black body followed by a small white body (contained within large black body). It is considered as a bullish pattern when preceded by a downtrend. |

| 6. |  | Bullish Harami Cross | Bullish Harami Cross A large black body followed by a Doji. It is considered as a reversal signal when it appears at the bottom. |

| 7. |  | Dark Cloud Cover | Dark Cloud Cover Consists of a long white candlestick followed by a black candlestick that opens above the high of the white candlestick and closes well into the body of the white candlestick. It is considered as a bearish reversal signal during an uptrend. |

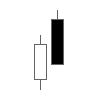

| 8. |  | Engulfing Bearish Line | Engulfing Bearish Line Consists of a small white body that is contained within the followed large black candlestick. When it appears at top it is considered as a major reversal signal. |

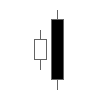

| 9. |  | Engulfing Bullish | Engulfing Bullish Consists of a small black body that is contained within the followed large white candlestick. When it appears at bottom it is interpreted as a major reversal signal. |

| 10. |  | Evening Doji Star | Evening Doji Star Consists of three candlesticks. First is a large white body candlestick followed by a Doji that gap above the white body. The third candlestick is a black body that closes well into the white body. When it appears at the top it is considered as a reversal signal. It signals more bearish trend than the evening star pattern because of the doji that has appeared between the two bodies. |

| 11. |  | Evening Star | Evening Star Consists of a large white body candlestick followed by a small body candlestick (black or white) that gaps above the previous. The third is a black body candlestick that closes well within the large white body. It is considered as a reversal signal when it appears at top level. |

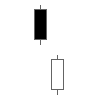

| 12. |  | Falling Window | Falling Window A window (gap) is created when the high of the second candlestick is below the low of the preceding candlestick. It is considered that the window should be filled with a probable resistance. |

| 13. |  | Morning Doji Star | Morning Doji Star Consists of a large black body candlestick followed by a Doji that occurred below the preceding candlestick. On the following day, a third white body candlestick is formed that closed well into the black body candlestick which appeared before the Doji. It is considered as a major reversal signal that is more bullish than the regular morning star pattern because of the existence of the Doji. |

| 14. |  | Morning Star | Morning Star Consists of a large black body candlestick followed by a small body (black or white) that occurred below the large black body candlestick. On the following day, a third white body candlestick is formed that closed well into the black body candlestick. It is considered as a major reversal signal when it appears at the bottom. |

| 15. |  | On Neckline | On Neckline In a downtrend, Consists of a black candlestick followed by a small body white candlestick with its close near the low of the preceding black candlestick. It is considered as a bearish pattern when the low of the white candlestick is penetrated. |

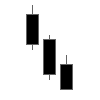

| 16. |  | Three Black Crows | Three Black Crows Consists of three long black candlesticks with consecutively lower closes. The closing prices are near to or at their lows. When it appears at the top it is considered as a top reversal signal. |

| 17. |  | Three White Soldiers | Three White Soldiers Consists of three long white candlesticks with consecutively higher closes. The closing prices are near to or at their highs. When it appears at the bottom it is interpreted as a bottom reversal signal. |

| 18. |  | Tweezer Bottoms | Tweezer Bottoms Consists of two or more candlesticks with matching bottoms. The candlesticks may or may not be consecutive and the sizes or the colours can vary. It is considered as a minor reversal signal that becomes more important when the candlesticks form another pattern. |

| 19. |  | Tweezer Tops | Tweezer Tops Consists of two or more candlesticks with matching tops. The candlesticks may or may not be consecutive and the sizes or the colours can vary. It is considered as a minor reversal signal that becomes more important when the candlesticks form another pattern. |

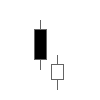

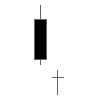

| 20. |  | Doji Star | Doji Star Consists of a black or a white candlestick followed by a Doji that gap above or below these. It is considered as a reversal signal with confirmation during the next trading day. |

| 21. |  | Piercing Line | Piercing Line Consists of a black candlestick followed by a white candlestick that opens lower than the low of preceding but closes more than halfway into black body candlestick. It is considered as reversal signal when it appears at bottom. |

| 22. |  | Rising Window | Rising Window A window (gap) is created when the low of the second candlestick is above the high of the preceding candlestick. It is considered that the window should provide support to the selling pressure. |

The detailed description of above mentioned Japanese Candlestick Complex Patterns will be explained in subsequent articles with examples.